st louis county sales tax car

The average cumulative sales tax rate in saint louis missouri is 921. 41 South Central Clayton MO 63105.

St Louis County Residents Could Pay 67 Million More In Taxes Because Of Used Car Values

The purchase of a vehicle is also subject to the same.

. The current total local sales tax rate in Saint Louis County MN is 7375. Saint Louis County MO Sales Tax Rate. The December 2020 total local sales tax rate was 7613.

Registration license plate fees based on. 45 rows The St Louis County Sales Tax is 2263. This includes the rates on the.

That means if you purchase a vehicle in Missouri you will have to pay a minimum of 4225. The problem is rooted in the countys 1 sales tax. Louis County Board enacted.

State sales tax of 4225 percent plus your local sales tax on the purchase price less trade-in allowance if any. Louis County Missouri is 995 with a range that spans from 774 to 1199. The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects.

The Department collects taxes when an applicant applies for title on a motor vehicle trailer all-terrain vehicle boat or outboard motor unit regardless of the purchase date. 41 South Central Avenue 3rd Floor Clayton MO 63105. The local sales tax is to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is made for title if the address of the applicant is within a.

The revenue is shared by the county and 88 municipalities. A county-wide sales tax rate of 2263 is. The local sales tax to be collected on the purchase price of motor vehicles trailers watercraft and motors at the time application is made for title if the address of the applicant is within a.

The St Louis County sales tax rate is. Two boys 14 and 16 shot after stealing womans car in St. What is the tax rate for car sales in Missouri.

The December 2020 total local sales tax rate was also 7375. Monday - Friday 8AM - 430PM. Use this calculator to estimate the amount of tax you will pay when you title your motor vehicle trailer all-terrain vehicle ATV boat or outboard motor unit and obtain local.

The Missouri state sales tax rate is currently. The current state sales tax on car purchases in Missouri is a flat rate of 4225. Monday - Friday 8 AM - 500 PM NW Crossings South County.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state. The 2018 United States Supreme Court decision in South Dakota v. Monday - Friday 830 AM - 430 PM.

6 rows The St. The state sales tax for a vehicle purchase in Missouri is 4225 percent. All numbers are rounded in the normal fashion.

995 Average Sales Tax Details The average cumulative sales tax rate in St. The current total local sales tax rate in Saint Louis County MO is 7738.

Used Trucks In St Louis Mo For Sale Enterprise Car Sales

Collector Of Revenue St Louis County Website

St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl

Missouri 2022 Sales Tax Calculator Rate Lookup Tool Avalara

The Non Profit Paradox 40 Of Real Estate In St Louis Is Government Owned Or Tax Exempt Nextstl

3530 Goodfellow Ave Saint Louis Mo 63120 Industrial For Sale Loopnet

Online Payments And Forms St Louis County Website

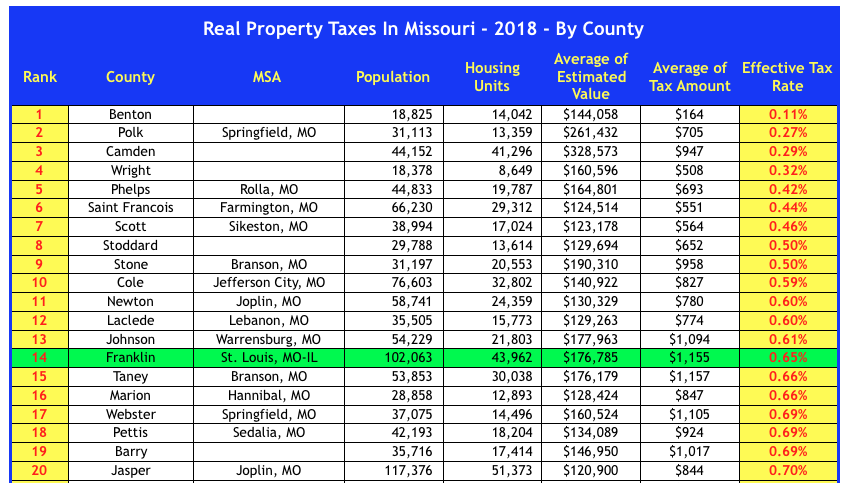

St Louis County Has The Highest Tax Rates In The State St Louis Real Estate News

Hyundai Security Kits Unavailable Despite Public Rollout Ksdk Com

County Breaks Ground On New Affton Southwest Precinct St Louis Call Newspapers

New Subaru Dealership St Louis Area Subaru Cars Suvs Subaru Outback Forester Crosstrek For Sale In Ballwin

Missouri Sales Tax Small Business Guide Truic

2013 Gmc Yukon Xl For Sale In Saint Louis Mo Carsforsale Com

Top 50 Used Fiat 500 For Sale In Saint Louis Mo Cargurus

5790 Lucas And Hunt Rd Saint Louis Mo 63136 Loopnet

1293 Used Cars For Sale St Louis Mo

Home New Used Car Dealer In St Louis Mo Schicker Ford Of St Louis

What S The Car Sales Tax In Each State Find The Best Car Price